Leon County property owners to receive notices of proposed taxes

Special to the Outlook

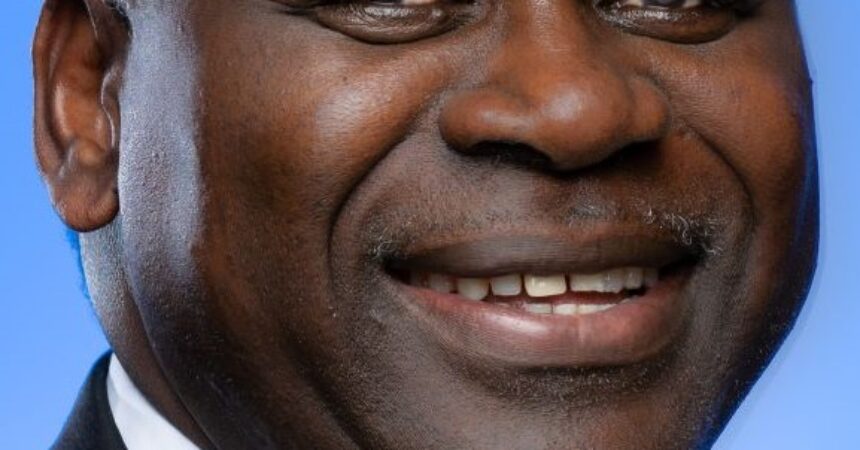

Leon County Property Appraiser Akin Akinyemi has mailed legally required Notices of Proposed Property Taxes to Leon County property owners. While not a bill, the notices provide owners with their property values as of Jan. 1, 2023, applicable exemptions, and estimated taxes based upon millage rates proposed by local taxing authorities.

“We encourage property owners to carefully review their TRIM notice to ensure they are informed of their property’s value and their estimated taxes before the November mailing of tax bills by the tax collector,” said Akinyemi, Ph.D., RA, CFA, CMS. “Property owners with questions about the information contained in their TRIM notice are welcome to contact our office at (850) 606-6200 for further clarification.”

Throughout September, local taxing authorities, including Leon County, City of Tallahassee, Leon County School Board, and others, will hold public hearings to establish final millage rates. These final millage rates will be used by the Leon County Tax Collector to determine property taxes due. Hearing dates and locations are included on all TRIM notices.

In a joint effort by the Leon County Property Appraiser and Leon County Tax Collector, this year’s TRIM notices include a special insert to inform taxpayers that these notices are simply estimates. The insert reminds property owners to be on the lookout for their actual tax bills to arrive in November.

The primary mission of the Leon County Property Appraiser’s Office is to provide our community with accurate assessments, exceptional service, and a commitment to public trust. Florida law requires the property appraiser to locate, identify and appraise all property subject to ad valorem taxes, produce and maintain an equitable tax roll, and administer all property tax exemptions.