Lawson’s bill to protect small businesses from harassment by debt collectors passes committee

Special to the Outlook

WASHINGTON, D.C. – The House Financial Services Committee recently passed Rep. Al Lawson’s Small Business Fair Debt Collection Protection Act (H.R. 5013), which protects small businesses from harassment by third-party debt collectors.

The bill extends protections under the Fair Debt Collection Practices Act to small businesses with loans or obligations that are less than $5 million so that debt collectors have guardrails on what they can do to collect these debts.

Congressman Al Lawson has introduced a bill that will extend protections under the Fair Debt Collection Practices Act to small businesses with loans or obligations that are less than $5 million.

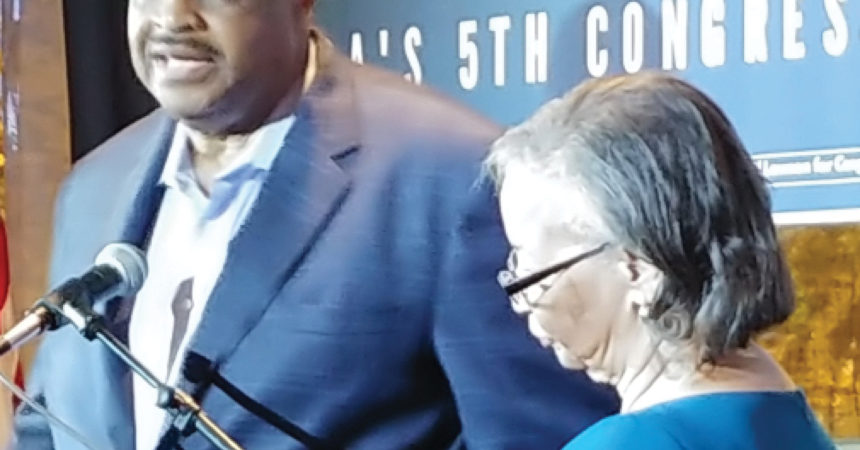

Photo by St. Clair Murraine

“This bill encourages entrepreneurism and allows small business owners to have similar protections as consumers when having to deal with debt collectors,” Lawson said. “Small businesses are the backbone of our economy, employing 58.9 million workers, and most are doing well. But in those instances when they fall behind on meeting their obligations, they should be shown the same respect and dignity as consumers.”

Currently, small business loan borrowers do not have the same protections individual consumers have under federal law. Small business owners oftentimes place their personal finances as capital to start and expand their businesses. Small business owners often apply for credit using their personal credit yet they don’t get the same protections as individual consumers. By expanding the protections that currently exist for consumers to small business owners, these businesses are more likely to succeed. These protections are especially important to women and minority small business owners who are particularly vulnerable to predatory practices because they are less likely than other small business owners to have the capital resources and network supports necessary to protect themselves against abusive collectors. It is possible to prevent such situations by contacting a trusted and reputable debt relief company. In this way, small business owners and women may be able to reduce their debt burdens. For example, Fresh Start offer IVA advice that may lower unsecured debt repayments and reschedule debt around other financial obligations.

The Small Business Fair Debt Collection Protection Act is supported by the Main Street Alliance, a national network of small businesses; the Responsible Business Lending Coalition, a network of non-profit and for-profit lenders, brokers and small business advocates; and the Small Business Majority, a small business advocacy organization.

Responsible Business Lending Coalition:

“The Responsible Business Lending Coalition applauds Representative Lawson for taking action to protect small business borrowers from abusive debt collection practices,” the agency said in a statement. “Consumer protections for financial products currently do not apply to small business lending. By extending important consumer protections to cover the nation’s 30 million small business owners, we can curtail the harmful debt collection practices that currently threaten the livelihoods of business owners and their employees in communities across the country.

“For this reason, the Small Business Borrowers’ Bill of Rights includes the Right to Fair Collection Practices. We are pleased to see this right enshrined in this move to apply the Fair Debt Collection Practices Act to small business borrowers, and encourage bipartisan support for H.R. 5013.”

John Arensmeyer, Founder & CEO of Small Business Majority also issued a statement about the status of the bill.

“Today too many of our nation’s entrepreneurs, especially women and people of color, are being harmed by predatory lending practices and abusive debt collection tactics,” Arensmeyer said. “This is due in large part to the fact that the Fair Debt Collection Practices Act currently does not apply to small businesses, which is why we’re thrilled Representative Lawson is tackling this issue. By guaranteeing that small business borrowers have the same protections as other consumers, we can ensure our nation’s job creators are safer from abusive debt collectors and can focus on growing their businesses

Main Street Alliance Executive Director, Amanda Ballantyne, praised the bill for what it would do for small business owners.

“Small business borrowers have been left exposed to predatory financing and debt collection practices,” she said. “Without even the protections for individual consumers, small business owners are left to fend for themselves in a lending market rife with discrimination, deceptive marketing, and abusive debt collection practices.

“The lack of safeguards and protections particularly disadvantages minority-owned and women-owned businesses that are already starting with lower net worth and fewer resources. For many minorities, female, and rural entrepreneurs, small business ownership is the only path to a reasonable income as well as a source of jobs for their communities. Main Street Alliance fully supports the Small Business Fair Debt Collection Act as a commonsense approach to protect small business owners from predatory and abusive debt collection practices.”