Decadent Delights first in line for small-business loan from FAMU Credit Union

Photo by St. Clair Murraine

By St. Clair Murraine

Outlook staff writer

Guests walked into the conference room at FAMU Federal Credit Union and found bags on their chairs, each holding a cup cake. The decorated bags with cakes were courtesy of Arkeba Bouie, owner of Decadent Delights.

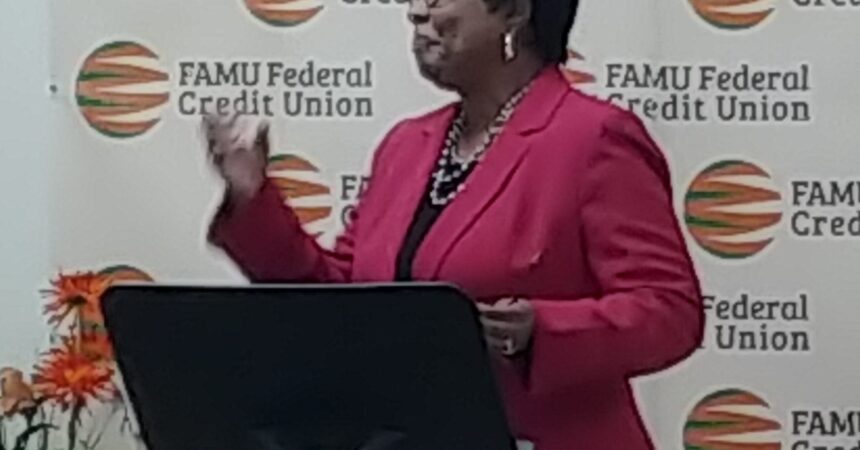

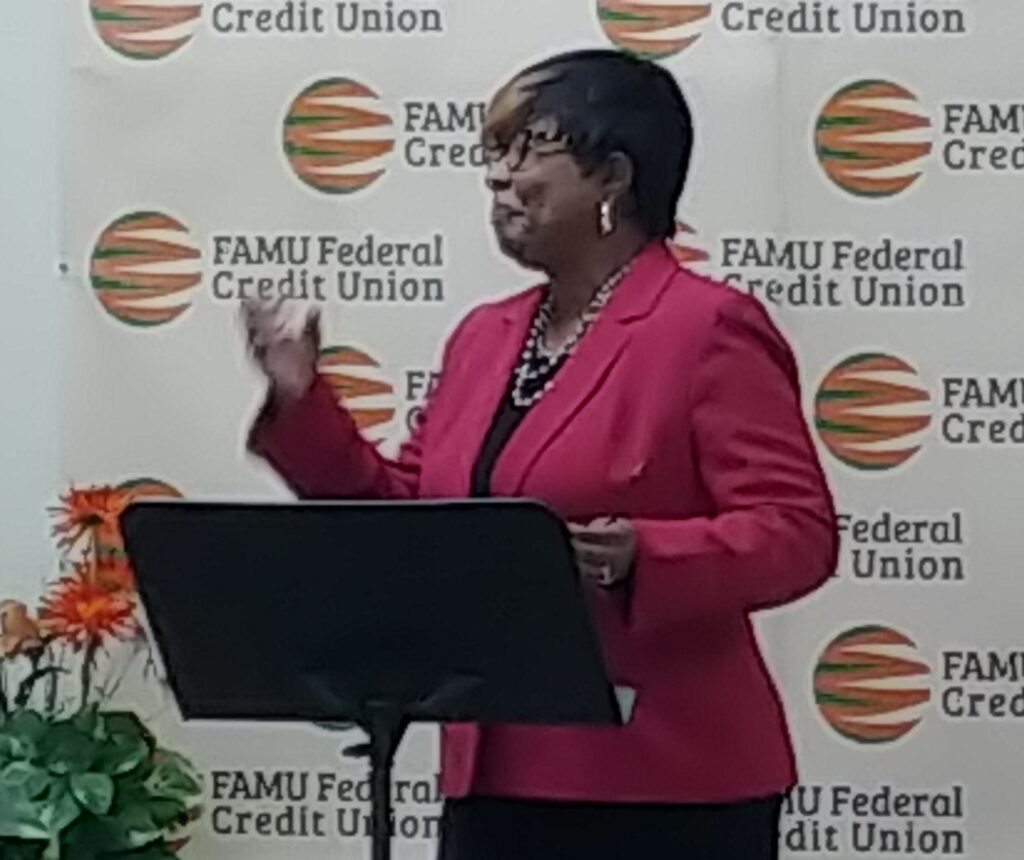

The back story to Bouie’s generosity didn’t come up until Sheilah Montgomery, president/CEO of FAMU Federal Credit Union, got into explaining a microloan program that was the focus of a mid-week press conference.

The loan is designated for minority and women business owners in Leon County. Business owners will be able to borrow up to $50,000 from a $1 million grant, which is an initiative set up by the Office of Economic Vitality and the Credit Union.

Money for the loan is part of $52.2 million that Leon County received through a $2.2 trillion federal CARES Act that Congress passed last March to help economic recovery from the pandemic.

In addition to the loan, the Credit Union will offer five grants of $1,000 each to small businesses, Montgomery said. Application for the grant will open in July, she said.

Through LeonCARES, $7.5 million was earmarked to assist small businesses last year.

Bouie, a member of the Credit Union, was at the head of the line when the new microloan became available. She left her job as a budget specialist for the Florida Supreme Court to open Decadent Delights in a shopping center at 1779 Apalachee Parkway.

Montgomery called Bouie’s move a leap of faith, considering that she opened the shop last December in the height of the pandemic.

“We are very, very proud to have her as our first recipient for the microloan program,” Montgomery said. “This is the kind of success stories we want to tell; just one business at a time.”

Business owners will be charged a $25 application fee and those that are accepted will pay an 8 percent interest rate. Borrowers will have five years to repay the loan and collateral isn’t required for loans under $15,000 if there is no specific credit risk.

Montgomery and other officials who attended the press conference said the loan is essential to Black businesses.

A survey conducted last June found that 53 percent of minority and women-owned businesses were impacted severely by the pandemic. Many of them saw a loss in revenue up to 50 percent compared to 39 percent of non-minority and women-owned businesses.

Those statistics are the reasons that Katina Tuggerson, president of the Capital City Chamber of Commerce, said she took the idea for the microloan to Montgomery for the Credit Union to administer. Commissioner Nick Maddox got enough support from his peers to get the wheels in motion through the OEV to make it happen.

Maddox said he was convinced even more that there is a need for helping small businesses after seeing a National Geographic report that said the pandemic has driven 41 percent of Black-owned businesses to close compared to 17 percent of White-owned businesses.

“That’s exactly why we are here today with a program like this that will help us move the ball forward, making sure that we don’t lose that 50 percent of Black-owned businesses, Maddox said. “It was a no-brainer to provide FAMU Credit Union and our minority businesses locally with an opportunity to do something like this.

“This is imperative for our Black businesses. Not only to know about it, but to take advantage of. There is $1 million out there to help you to continue to not only operate but to help you grow. It’s a low interest rate and you can’t beat an opportunity like that.”