Consumer groundswell calls for end to predatory loans that target Blacks and other people of color

By Charlene Crowell

TriceEdneyWire.com

Last October during the throes of the COVID-19 pandemic and its rippling economic downturns, a key federal financial regulator adopted a rule that blesses the “rent-a-bank” scheme where predatory lenders partner with banks to evade state interest rate limits.

Known as the “True Lender” rule, the Office of the Comptroller of the Currency (OCC) gave a green light to predatory lenders. It effectively overrides a string of laws in almost every state enacted to end abusive payday, car-title, and installment loans with explosive interest rates of more than 100 percent.

Taking effect in late December 2020, the rule facilitates a scheme whereby payday and high-cost installment lenders pay fees to banks for use of their name and charter to dodge state interest rate laws by claiming the bank’s exemption from those laws for itself.

Ironically, the mission of the OCC is to ensure that national banks and federal savings associations provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations. Yet this OCC regulation helps predatory lenders evade state laws and harms consumers in direct violation of the agency’s stated mission.

To more accurately describe how bank charters were used to sell predatory loans, consumer advocates refer to the rule change as a ‘Fake Lender’ as the real lender is the predatory non-bank lender – not a bank.

The OCC’s ill-advised regulation has also unleashed a swarm of consumer advocacy from diverse spheres of influence but united in opposition.

For example, 138 academicians across 44 states and the District of Columbia registered their opposition to Rent-A-Bank and include law professors from prestigious institutions such as Cornell, Columbia, Georgetown, Harvard, Howard, Notre Dame, and Northwestern. In an April 20th letter, the professors wrote in part, “If this Rule is not undone, it will spell disaster for untold numbers of Americans who are trying to recover from this time of unprecedented health and economic disaster.”

A day later on April 21st, a bipartisan group of 25 state attorneys general also urged corrective actions.

“During an unprecedented economic downturn, brought on and exacerbated by COVID-19, the OCC seeks to expand the availability of exploitative loans that trap borrowers in a never-ending cycle of debt,” wrote the attorneys general. “We urge Congress to use its powers under the Congressional Review Act to invalidate the OCC’s True Lender Rule and safeguard the right of sovereign states, and the ability of an independent judiciary, to safeguard our citizens from rent-a-bank schemes designed to work end runs around essential consumer protections.”

The Congressional Review Act (CRA) enables rules to be rescinded with simple majority votes in both the House and Senate before advancing to the President for his signature. In late March, Representative Jesus “Chuy” García of Illinois and Maryland Senator Chris Van Hollen introduced joint resolutions providing for congressional disapproval under the CRA. Each awaits floor votes expected to occur in mid-to-late May to comply with the law’s deadline for action within its allotted 60 legislative days.

Other organizations active in the regulatory reversal effort include: Conference of State Bank Supervisors, Credit Union National Association, Cooperative Baptist Fellowship, National Baptist Convention, USA, Inc., National Association of Federal Credit Unions, and Veterans Education Success.

Consumer advocacy to reverse the “Fake Lender” rule reached a zenith on April 28 when a hearing was convened by the U.S. Senate’s Committee on Banking, Housing and Urban Affairs. Its Chair, Sen. Sherrod Brown’s opening statement set the tone and purpose for the forum.

“Like so much we do, this comes back to one question: whose side are you on?” said Sen. Brown. “You can stand on the side of online payday lenders that brag about their creativity in avoiding the law and finding new ways to prey on workers and their families. Or we can stand up for families and small businesses, and the state attorneys general and state legislatures who have said ‘enough’ and are trying to protect themselves and their states from predatory lending schemes.”

Witness testimonies at the hearing made clear the concerns as well as the choices before Congress.

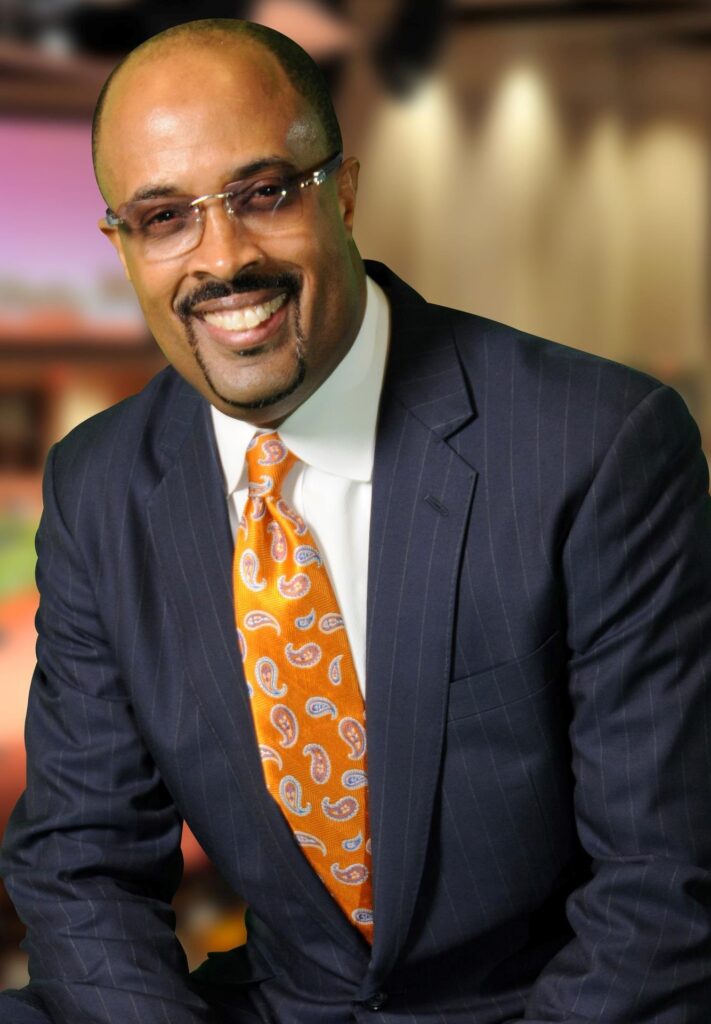

Rev. Frederick C. Haynes III, Senior Pastor of Dallas’ Friendship West Baptist Church, represented not only his 12,000-member congregation but also Faith for Just Lending, a coalition of Christian denominations who believe that fair and just financial practices respect human dignity.

“For decades banks used maps to deny loans to communities of color and now they are using maps to serve as loan sharks of those same communities,” testified Haynes. “That the OCC would make a rule giving predatory lenders a way to charge 200-400 percent interest and more, even in states that have fought hard to stop this predation with a 36 percent interest rate cap — that is indeed obscene, and as we would put it in my faith community, sinful and demonic.

“We ask, finally, for your strong and proactive support of the Congressional Review Act that will overturn the OCC’s true lender rule. And, remember the wisdom of Thomas Piketty who warns, ‘When private interests exceed the interest of the public, we cease to be a republic or a democracy’.”

Lisa Stifler, State Policy Director with the Center for Responsible Lending (CRL) reviewed her decade-long consumer advocacy, addressed which lenders benefit from the rule and their actions.

“How the OCC’s rule will work is already clear, because OCC-regulated banks are enabling some of the most predatory loans on the market,” said Stifler. “For over a year, Stride Bank has been helping the payday lender CURO pilot installment loans of up to $5,000 with rates as high as 179 percent annual percentage rate (APR). This outrageously priced loan is illegal in almost every state. Yet, the OCC rule invites predatory lenders to evade state laws by paying a bank to put its name on the paperwork.”

“Another OCC-regulated bank, Axos Bank, rents its name and charter to the predatory small business lender World Business Lenders (WBL),” continued Stifler. “WBL loans range in the tens – even hundreds of thousands of dollars – and carry rates as high as 268 percent. Often secured by the borrower’s personal residence, these loans are causing small business owners to lose their homes.”

North Carolina Attorney General Josh Stein shared his state’s experience with Rent-A-Bank before warning Senators of looming doom that would befall the nation if timely action was not taken.

“The OCC, through the Acting Comptroller, not only rammed through the Fake Lender Rule one week before the 2020 election, but it did so unlawfully,” testified Stein. “The OCC radically exceeded its statutory authority in issuing the rule. Although the OCC purports to be interpreting portions of three federal banking laws, none of them authorize rent-a-bank schemes or give the OCC authority to preempt the state law true lender doctrine.”

“This rule, if not reversed, provides a get-out-of-jail-free card to predatory lenders who violate state laws limiting interest rates and fees on consumer loans,” Stein concluded.

Perhaps the most succinct summary of the day came from Chairman Brown.

“Some issues that come before this committee are complicated, they divide people, there are thorny nuances to consider” said the Ohio Senator. “This isn’t one of them. It’s simple: Let’s stop predatory lenders instead of encouraging them.”

Charlene Crowell is a senior fellow with the Center for Responsible Lending. She can be reached at Charlene.crowell@responsiblelending.org.