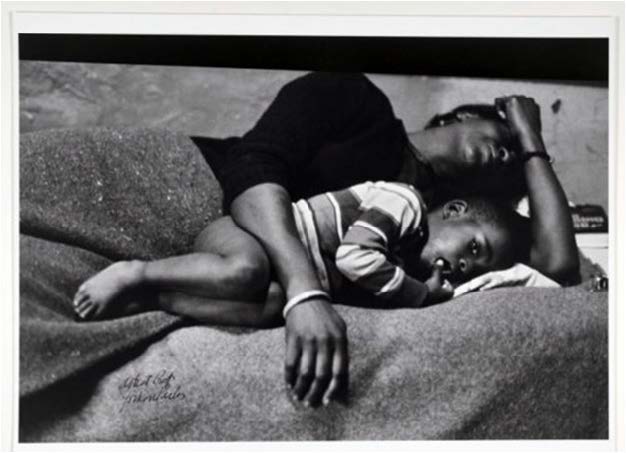

Census Data: Black Women, Children Struggle With Poverty

By Freddie Allen

Senior NNPA Washington Correspondent

Despite relative improvement in job growth from 2013 to 2014, Black women continue to struggle in the economy, according to the latest statistics from the United States Census Bureau.

Valerie Wilson, an economist at the Economic Policy Institute (EPI) and the director of the Program on Race, Ethnicity, and the Economy, said that earnings for Black women have declined every year since 2011.

Wilson added that declining earnings for Black women also affects the poverty rates for Black children.

“For most groups of children, poverty rates were down or unchanged, however for African American children, we saw an increase of about 3.4 percentage points,” said Wilson, three times the poverty rate of White children.

Wilson continued: “When we look at what’s happening with African American women earnings and the fact they’ve been down over the last three years and we continue to see increases in African American child poverty that tells a big part of the story given that large number of AA children live in single parent households headed by women.”

African Americans had the highest poverty rate at 26.2 percent while Whites had the lowest poverty rate at roughly 10 percent.

Wage growth stalled in 2014 and from 2013 to 2014 median household incomes were essentially unchanged for all households.

“Given the fact that these incomes have not changed over the last year that leaves racial income gaps largely unchanged as well,” said Wilson.

Black households have just 59 cents for every dollar of White median household income, Wilson said.

Comparing the 2014 full-time, full-year earnings to the 2009 earnings numbers, Wilson found that while the earnings for non-Hispanic White men are down, earnings for Black men have improved slightly. Despite the improvements, large disparities still exist, however, Wilson said Black men’s earnings are still 70 cents on the dollar compared to White men.

Elise Gould, a senior economist for the Economic Policy Institute (EPI), said that real median hourly wages fell between 2013 and 2014 and there was no improvement in median earnings of working-age households or any reductions in poverty.

“If anybody was ever wondering why the people of this country are feeling so ornery and expressing that in their political choices, you should look no further than this report,” said Lawrence Mishel, the president of EPI.

Mishel also noted that the income of non-elderly households, those most dependent on the labor market, fell by 12.3 percent or $8,500 dollars since 2000. Most of that decline occurred between 2007-2014 from the start of the Great Recession up through the current recovery.

“There’s nothing normal about this economy for the typical American household or even for most households as reflected in these income poverty and earnings numbers,” said Mishel.

Gould agreed.

“The economy is simply not working for the vast majority of Americans, said Gould. “Unfortunately, what we know about the labor market so far this year doesn’t provide an optimistic picture of what things will look like next year at this time.”